Next Gen M&A

Combines investment banking expertise, proprietary data, and a cloud-based deal management platform to help companies achieve growth through strategic transactions

Clients assisted

0

+

75

%

of deals completed by Danescor

clients are off-market

Average buy-side client completes

deals per year

>

3

1-2

deals per week across our platform

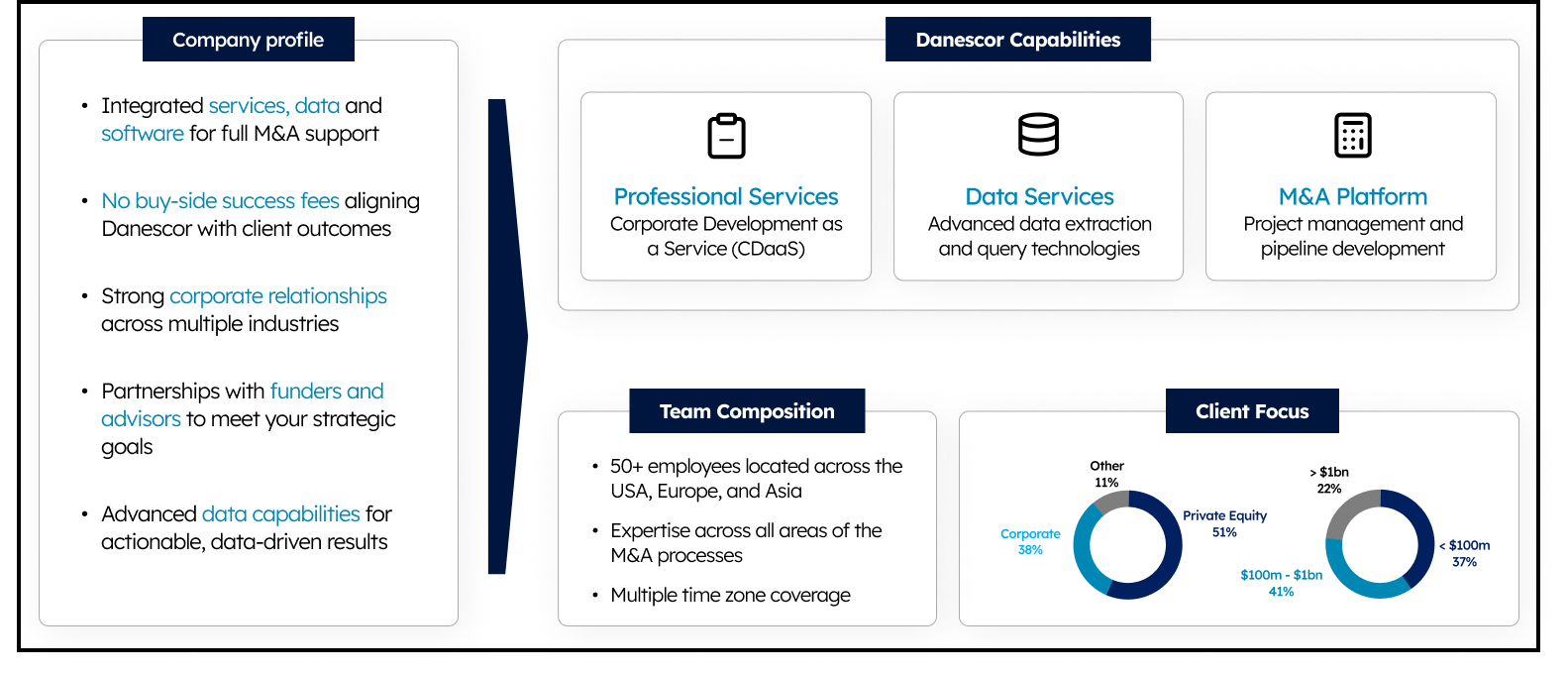

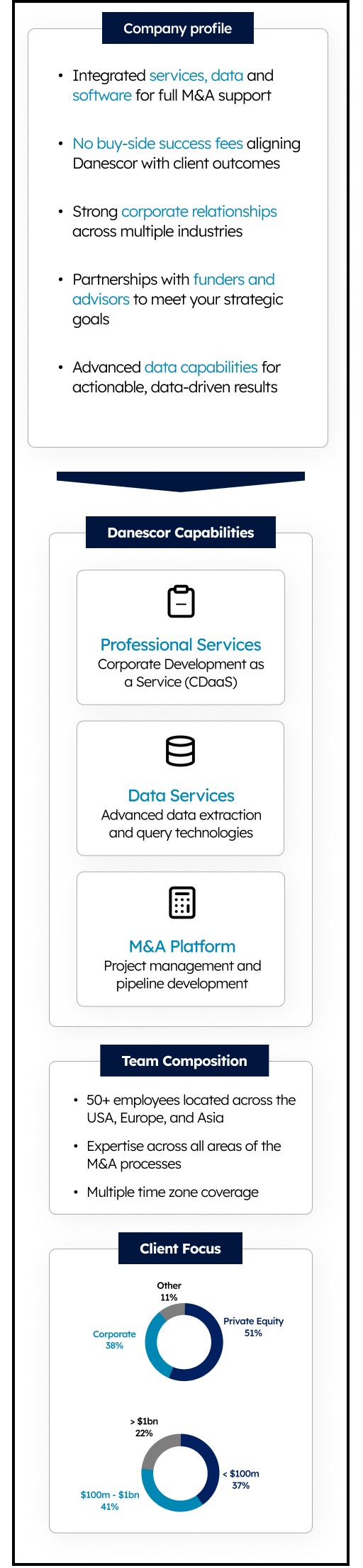

Danescor is a leading provider of M&A services and transaction support

Danescor is a leading provider of M&A Services and transaction support

How We Do It

How We Do It

Enhanced M&A process

We work with C-suite and corporate development teams to super charge the efficiency and effectiveness of their acquisition strategies

“Danescor's strategic guidance and industry knowledge were key in us achieving a successful outcome. Their dedication and professionalism ensured we achieved a superior result for all our shareholders.”

Barry EdwardsCEO Splicecom

"We continue to partner with Danescor who support us in our M&A program, based on their deep sector knowledge, proprietary market intelligence and their unique business model”

Mark SimonsCEO Prime Networks

“FluidOne have partnered with Danescor to accelerate the implementation of ambitious growth plans involving strategic acquisitions. The intelligence and insight provided by the platform are further leveraged by Danescor’s professional services team enabling FluidOne to maximize Management’s time and attention on concluding the best fit opportunities.”

Russell HortonCEO FluidOne

"We selected Danescor as our M&A advisor for their market leading platform, which delivered unparalleled value and buyer intelligence, and proved invaluable to our successful outcome."

Michael DaviesChariman Centrality

"Danescor supported and accelerated the process of researching, identifying, and making the initial approach to targets that matched our acquisition criteria. They built a solid pipeline of both on and off-market targets and we thoroughly recommend using them. We will be using them again for the continuation of our buy and build strategy."

Russell TodhunterCEO Atech Support

"Having worked with the Danescor team over a number of years, we appreciate the value they brought to everyone involved in the process. In this case. having a well advised seller smoothed the path properly understanding the business and it’s potential as part of an enlarged Windsor Telecom."

Pete TomlinsonCEO Windsor

Client Testimonials

Frequently asked questions

How does Danescor deliver Corporate Development as a Service?

We deliver end-to-end services in a modular format to execute an M&A pipeline. Clients determine which services are required and at which stage either through our full outsourced offering or an extension of their internal M&A teams.

How can Danescor help me?

- Seamless combination of M&A professionals, software and data analytics, to help you achieve a comprehensive market-scan in-order to focus on the top quartile ROI prospects.

- End to end M&A capabilities – whether it’s target outreach & engagement, target evaluations, DD, PM we provide a complete set of skills and services which can be leveraged at any point.

- Retainer pricing model – our sole focus is on finding best fit targets, not pushing any one deal to generate a payout.

What can I achieve with Danescor?

- We undertake a comprehensive process to uncover, manage and progress the best fit opportunities.

- Most commonly Danescor runs an M&A funnel for clients containing mid to high hundreds of prospects, with clients on average completing more than three acquisitions a year and many into double figures.

- See our case studies of recent projects.

What type of companies work with Danescor?

- Our clients range from multi-billion dollar corporates, with sophisticated in-house resources to private equity owner managed business looking to complete their first acquisition. Primarily we work with companies who have decided that acquisitions are a meaningful component of their growth plans.

- Our proprietary market data and leading edge transaction management software efficiently leverages the output delivered from our experience professional services team.