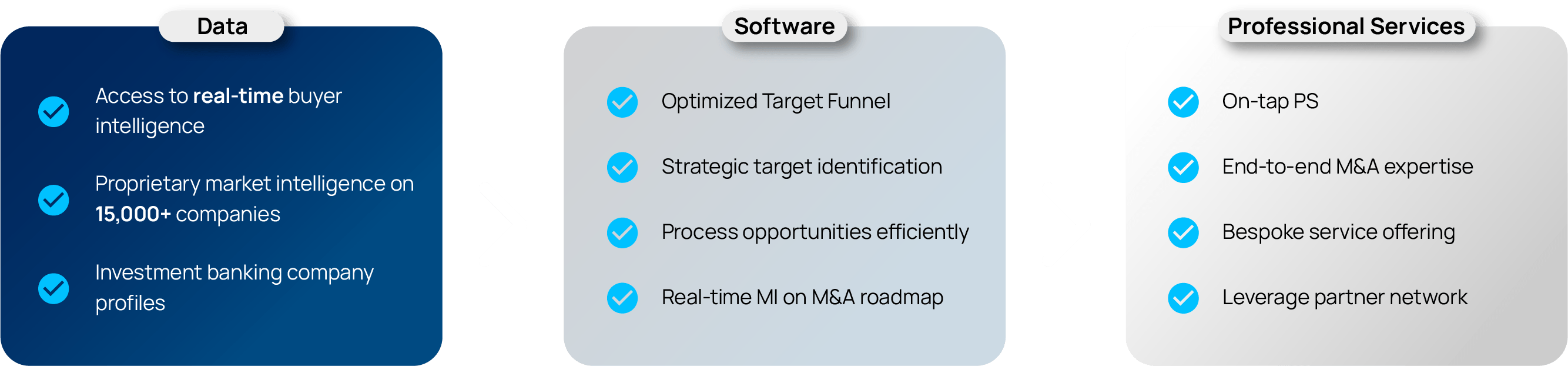

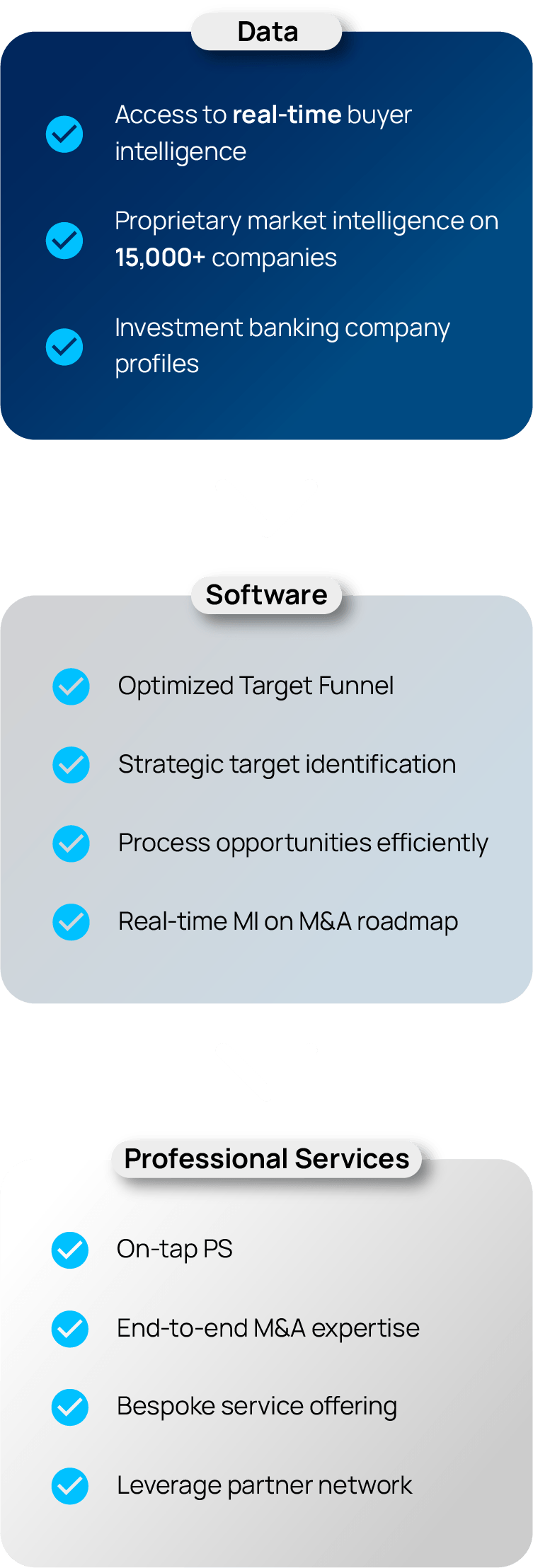

Danescor is a leading online corporate M&A platform with operations across the US, UK and Europe

Transaction Management Application

Danescor combines proprietary market intelligence & data with bleeding edge technology. Our UX drives efficiency and unrivalled performance to complex M&A transactions.

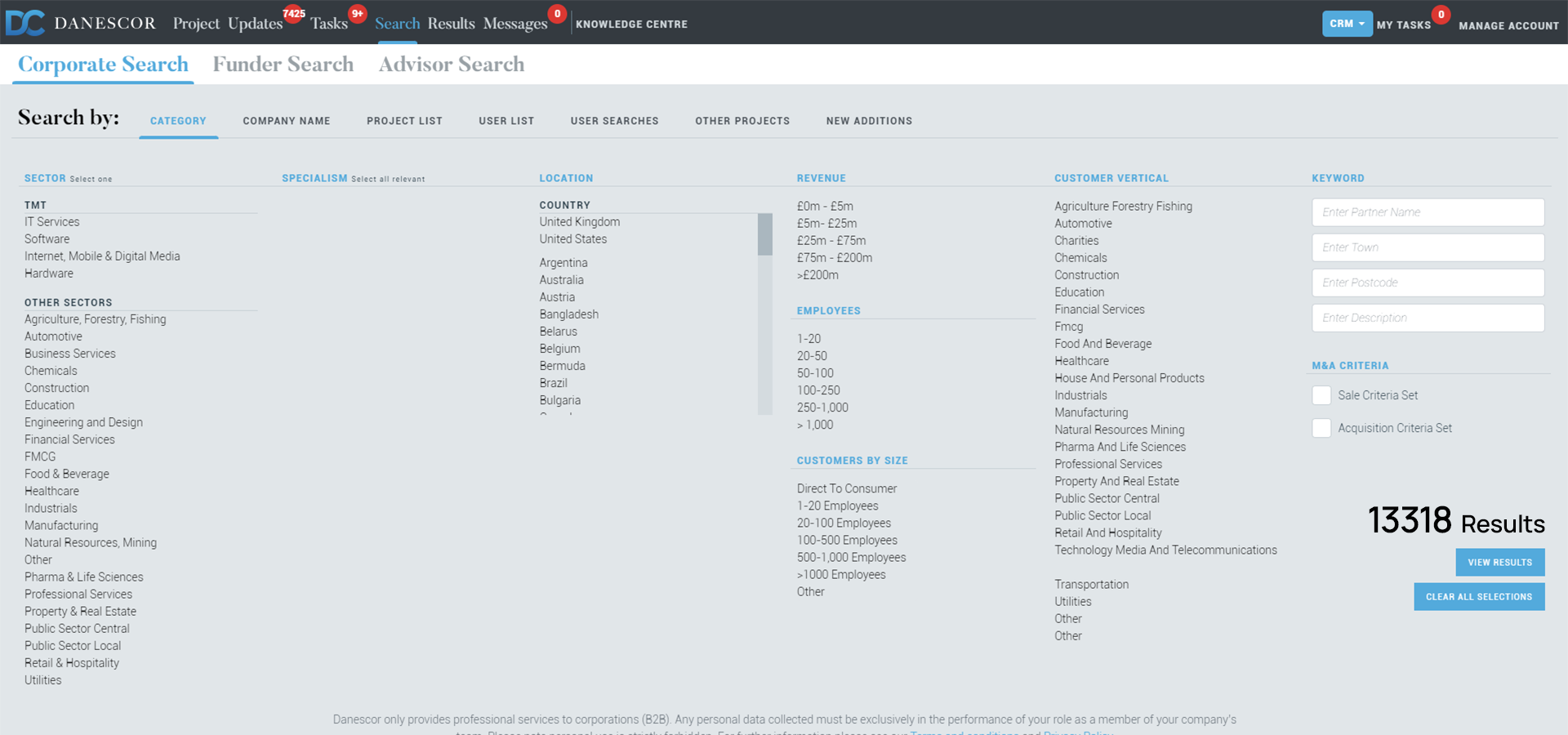

Target Universe Building

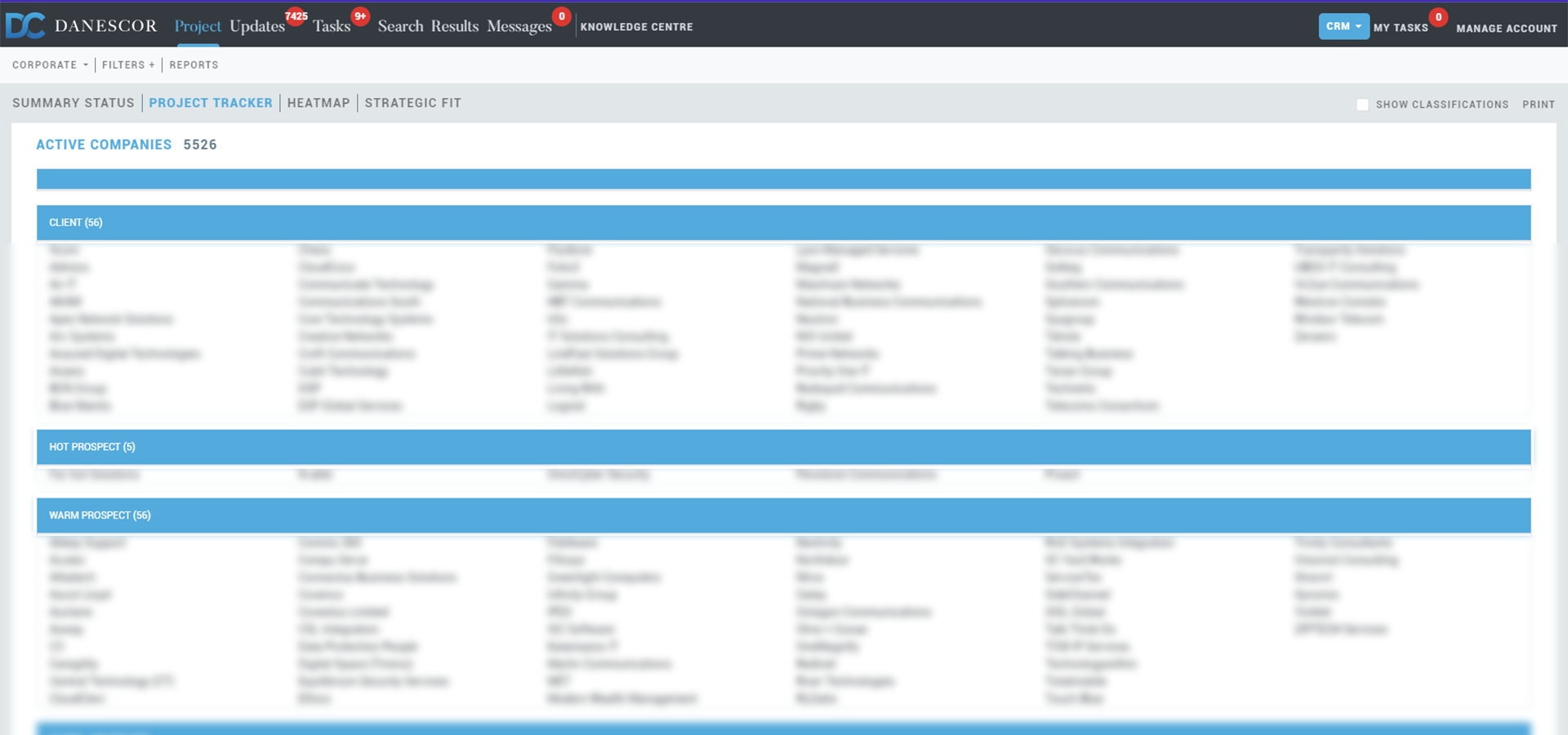

Pipeline Management

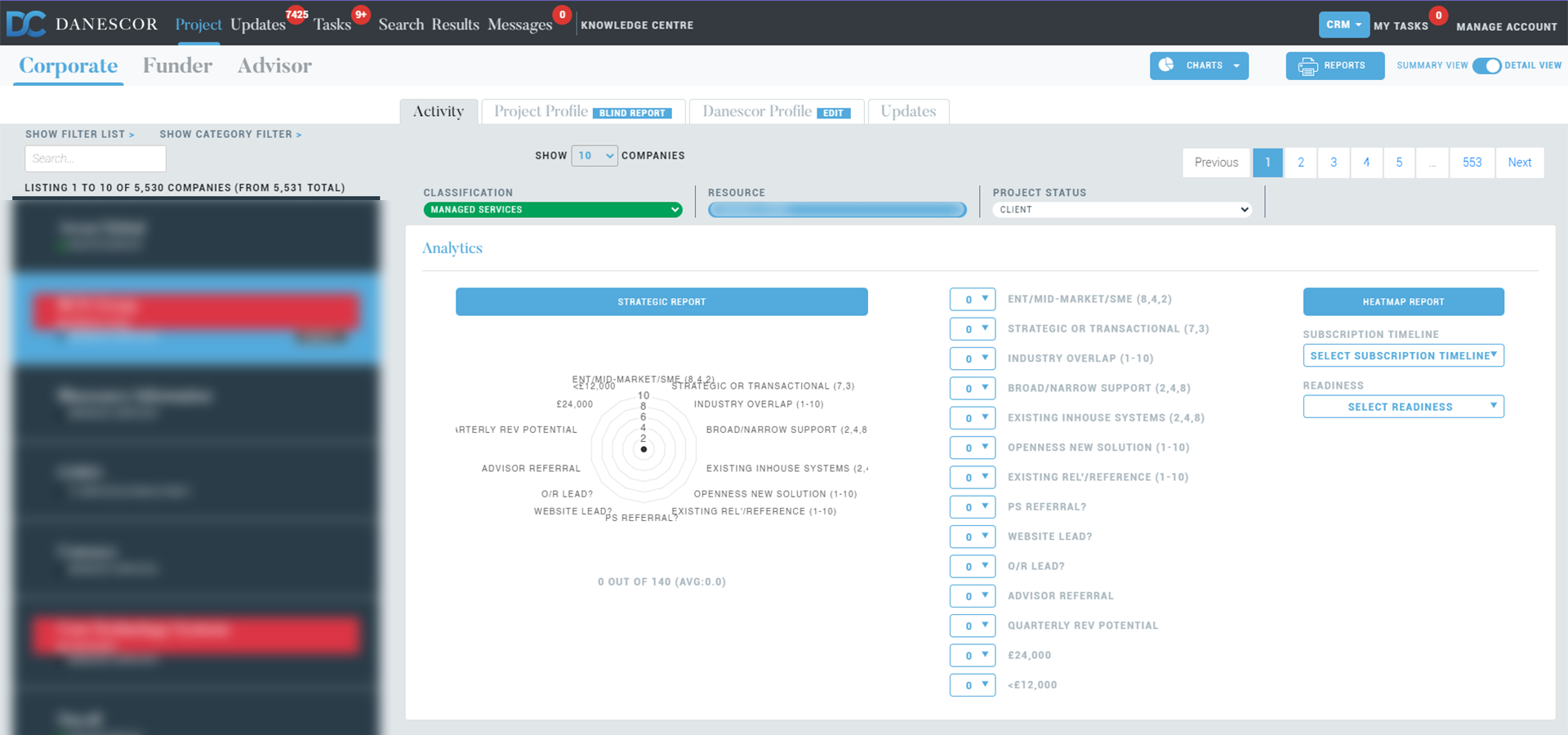

Scoring Analytics

Target Universe Building

Pipeline Management

Scoring Analytics

01

Set up your project in minutes with quality data from the start

02

Templates refined and tested on hundreds of real transactions

03

Strategic reporting and analytics

04

Proprietary data, bleeding-edge software and IB class transaction reporting

Project Aderna – MSP

Project Memphis - MSP

Project Ciera – MSP

Project Comet – Cyber

Project Oklahoma – IT Services

Project Winter - Cyber

Project Savannah - Cyber

Project Igloo – IT Services

Project Bahamas – Telco

Project Nova – Telco

Project Tenessee – Cyber

Project Camberwell – Telco

Project Quantum – MSP

To succeed

01

Must have a robust, accurate and realistic acquisition criteria

02

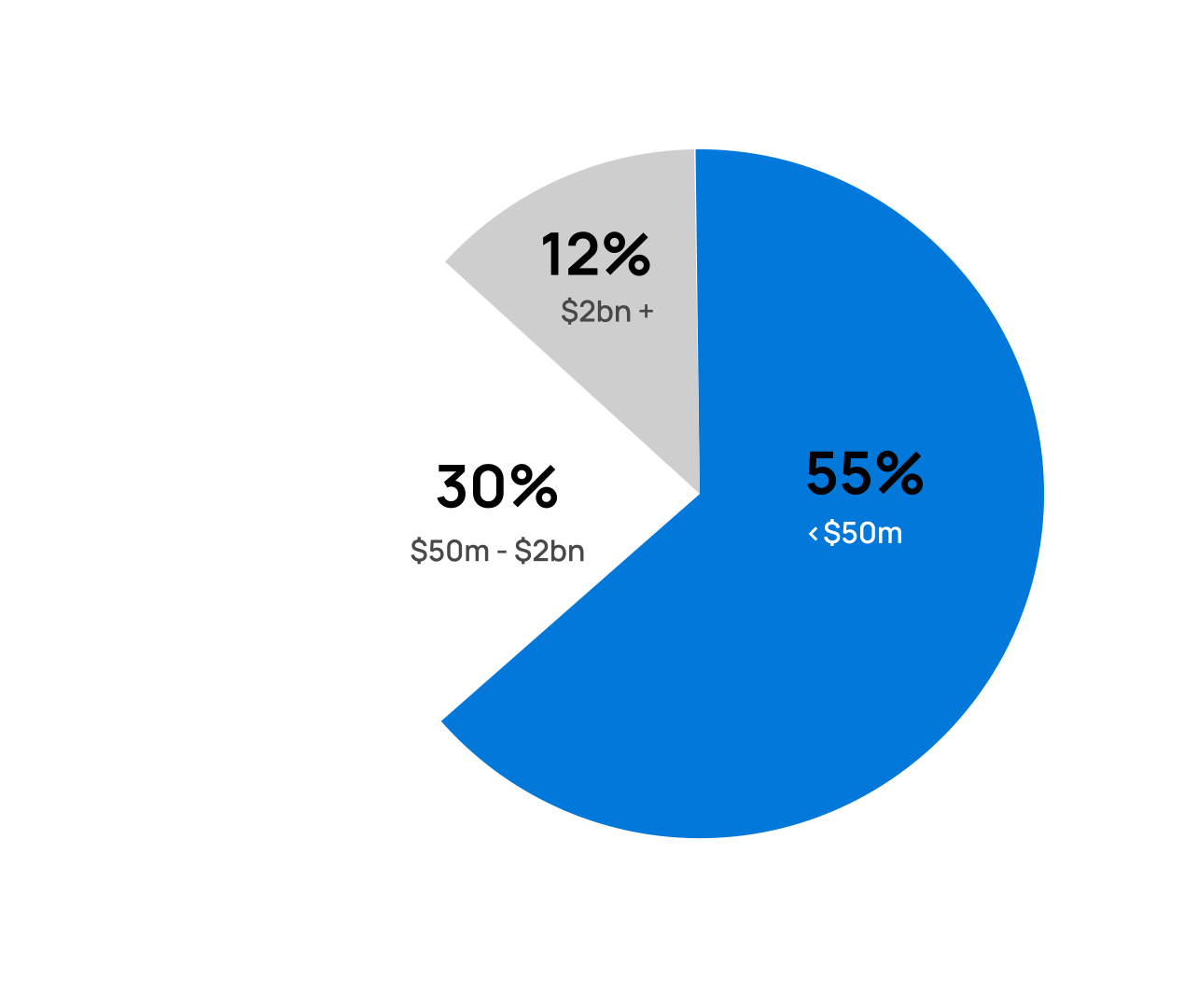

Large, accurate, well researched funnel (c.100+ targets for each conversion)

03

Best data and software to process the funnel efficiently + expert resource to reach the best outcome

Collaborative Ecosystem

- C-suite confidential messaging

- Combination of listed, Private Equity, Owner Managed

- 100s of transactions completed by the team

- Large network of strategic partnerships across the M&A process

- Legal, due diligence, strategy, and taxation specialists

- CEO with 35+ years of M&A Experience