Sell-side

M&A Advisory

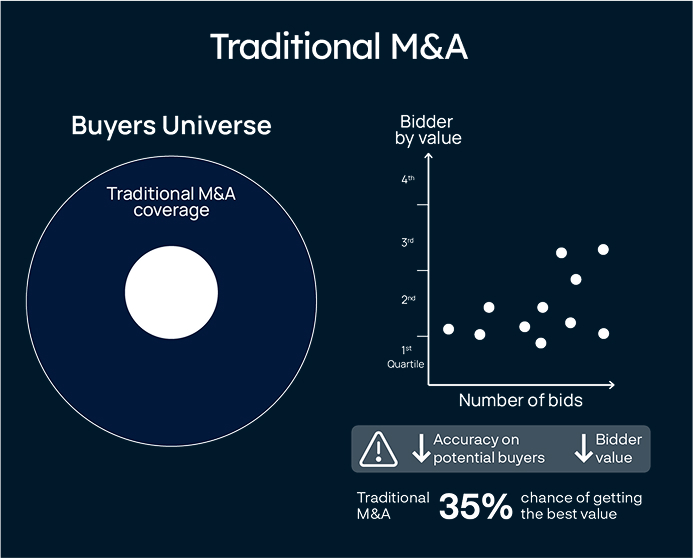

When you are exploring a sale of your business the single most important aspect to get right is to make sure you are talking to the right buyer.

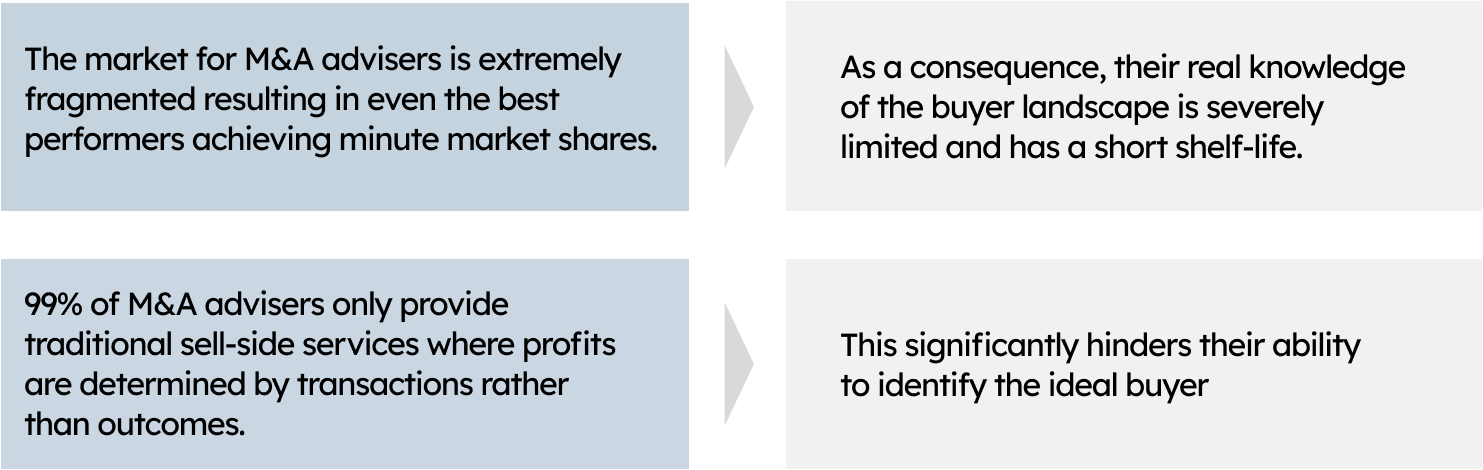

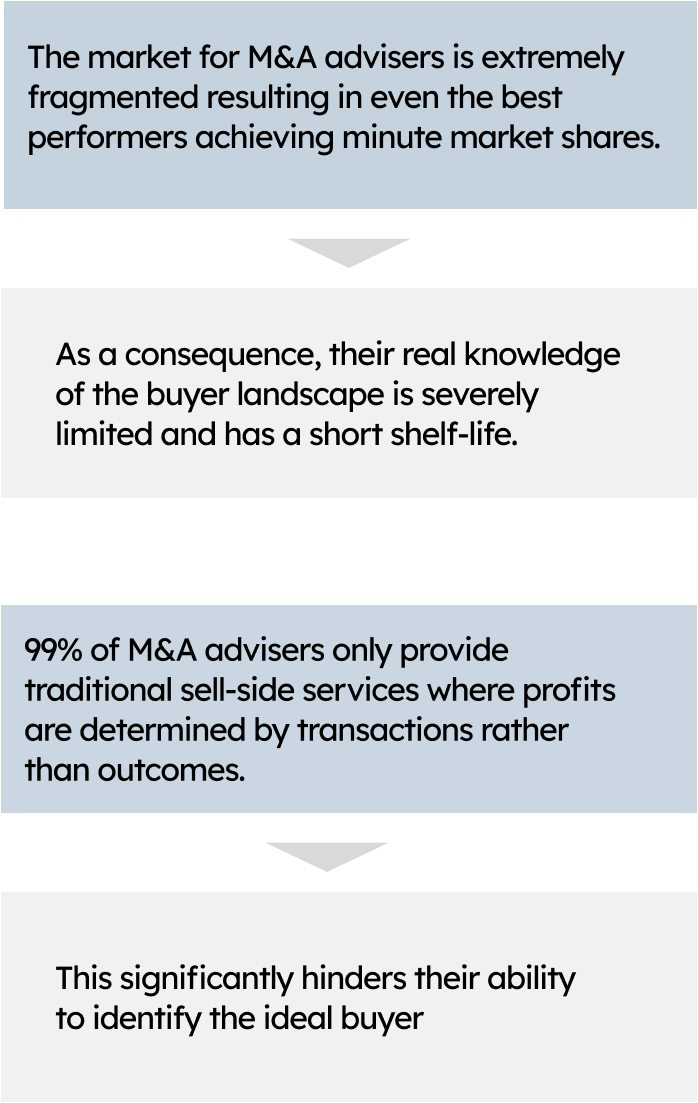

- Most investment banks are almost exclusively sell-side focused, meaning their buyer intelligence is extremely limited.

- We conduct a large volume of transactions in the sectors we focus on which gives us unrivaled market intelligence, and the ability to identify the ideal match.

- Our unmatched knowledge of the buyer landscape provides much more than who is buying and what the market rate is, it provides the specific nuances of which buyer is looking for what.

- Proprietary intelligence, enables us to focus on what matters the most to you when you are selling - who will buy my business and at what price.

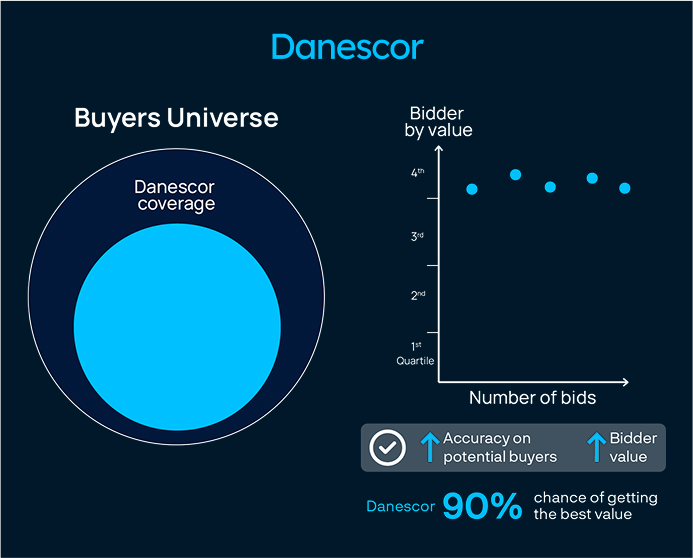

How we do it...

Danescor identifies the “best-fit” buyers by leveraging real-time proprietary buyer intelligence, extensive market analytics and unrivalled industry knowledge.

Our unique outreach campaign strategies incorporating covert intelligence together with our market leading transaction management software ensures optimum results are achieved.

vs Competitors

The Optimum Outcome

Danescor’s market focus and network of relationships, together with its transaction

volume, provides a competitive edge and the optimal outcome.

Best fit buyer → Will pay the best price

Case studies

Centrality Management Limited

Problem

Our client, a market leading MSP with a very specialized capability offering was looking to explore a sale of the business to a strategic acquiror after building and growing the business for a number of years. Having been approached by numerous trade and financial buyers over several years, they were looking for expert advice and guidance to achieve the optimum outcome and ideal fit for the business.

Objective

Identify, engage, evaluate and negotiate with the best fit strategic acquiror in a highly confidential and sensitive process.

Solution

Create best in class marketing materials to support and deliver on a strategic

transaction, ensuring potential acquirors fully appreciated the value of the opportunity. Using proprietary market intelligence identify and engage with the best fit strategic buyers executing a focused and targeted process. Maintained competitive tension which resulted in a successful outcome meeting all of the shareholders objectives.

Client

“We selected Danescor as our M&A advisor for their market leading platform, which delivered unparalleled value and buyer intelligence, and proved invaluable to our successful outcome.”

Bridge Partners Limited

Problem

Our client, a market leading MSP with a very specialized industry sector offering was looking to explore a sale of the business to a strategic acquiror after building and growing the business for a number of years. Having been approached by numerous potential buyers both financial and trade, shareholders were looking for expert advice and guidance to achieve an optimum outcome and ideal fit for the business.

Objective

Leverage deep market intelligence and established relationships to identify, engage, and negotiate the ideal outcome in a highly confidential and sensitive sector.

Solution

Create best in class marketing materials to support and deliver on a strategic

transaction, ensuring potential acquirors fully appreciated the value of the opportunity. Manage a tightly focused and highly confidential marketing process to engage and negotiate with “best fit” potential acquirors, maintaining competitive tension throughout the process to ensure the optimum solution in-line with shareholder objectives was achieved.

Client

“We have found your advice and guidance throughout this process to be first class.”

Frequently asked questions

How do I maximize value in a sale process?

You need to find the company who has most to gain from acquiring your business, if you are a ‘7 out of 10’ fit for a buyer, he will give a ‘7 out of 10’ offer. You need to find a buyer for whom you are a 9/10. Once you are clear how the ideal buyer can create value from acquiring your business you need to ensure that this is clearly outlined in the marketing documentation.

What are the key drivers that affect value?

Value is directly related to the future profits that the acquiror can realize from the acquisition. Your ability to reduce risk and increase the certainty of those future profits will underpin the

value of the business. Growth will often outweigh other value drivers, but it needs to be clearly demonstrated that it will continue into the future, and why. Business risks such as customer

or supplier concentration, personnel, pricing or other resource reliance all need to be considered in addition to threats from competition or new market entrants. Buyers will focus on overdependence in these areas in-order to evaluate, what will the likely impact be from, key customer churn or other factors.

What is typically involved in the M&A process?

Preparation: This initial phase involves establishing clear goals and objectives for the transaction, who are the likely buyers and what information such as a confidential information memorandum or CIM will be needed for both the marketing and due diligence phases.

Marketing: The marketing phase involves reaching out to potential acquirors with a summary blind document or teaser, engaging with them and sharing other relevant information such as a CIM in-order to establish and assess interest, ‘fit and appetite’ for the transaction.

Closing: Closing involves negotiating and agreeing on an outline offer for the transaction which is documented in a Letter of Intent or Heads of Terms before embarking on a due diligence exercise and negotiation and completing of the necessary legal documentation such as a purchase agreement etc.

What documentation and preparation will I require?

Most sale processes will entail a Teaser, NDA, CIM, Financial Pack, responses to due diligence questionnaires as well as a disclosure letter and bundle. The Teaser is an initial overview of the opportunity with typically runs to one or two pages and does not reveal the identity of the vendor but is used to gauge and vet initial interest from potential buyers. The NDA (Non-disclosure Agreement) or CA (Confidentiality Agreement) is entered into with interested buyers to maintain confidentiality before releasing the CIM. The CIM or Confidential Information Memorandum is essentially a marketing document setting what they company does, how it does it, who it does it to, what resources it has to support its operations and what financial performance results from its operations. The CIM can vary in length from circa 20 pages on the low end to 60 or 80 pages on the high end, but its fundamental objective is accurately filter out and identify genuinely interested buyers. Ideally, having read the CIM the buyer should have a clear understanding if he is interested in acquiring the business except for assessing cultural fit and chemistry etc. A financial pack may also be used to establish and agree on detailed price negotiations prior to entering exclusivity and embarking on a formal due diligence process thus so limiting the scope for price re-negotiation post due diligence. Data room preparation is something which warrants serious consideration well ahead of agreeing and signing an LOI and entails selecting a market-leading Virtual Data Room (VDR) solution such as Danescor’s as well as populating it with appropriate information likely to be asked for in due diligence questionnaires

How did I minimize the risk of my sale process failing over?

The most important aspect to bear in mind is does the buyer fully understand your business and is it clear to you why they want to acquire your business. Having established and understanding the logic you need to make sure they have all of the information which is likely to impact value before agreeing and signing the LOI or HOTs. The only acceptable basis for changing the terms of the LOI when completing the legal documentation is that during due diligence a) the buyer leant new information AND b) that the new information learnt has a bearing on value.

How do I maintain confidentiality through the transaction process?

There is a common saying if you want to keep a secret then don’t tell anyone. Clearly, when exploring a sale process, it is necessary to engage with potential buyers who may not be interested but your ability to focus on the best fit buyers and adopt a strategy to establish interest before revealing your identity is paramount. Danescor’s propriety transaction software places you the vendor in complete control of your own process thus ensuring the tightest and most effective approach to maintaining confidentiality.

How do I decide what help I need from advisers and how do I select them?

You will know your business better than anyone else and as a result you are likely to be a) the best judge of potential fit with a particular buyer and b) the best person to explain your business to a potential acquiror. However, you are likely to have a full-time job running your business and so may well need experienced advice and assistance to complete your transaction. Be clear in your own mind what help you actually need rather than what help advisers want to provide or sell. Make sure the advisor you choose has SIGNICANT experience both in your market and with the type of transaction you are contemplating. Don’t fall for the aspirational purchase or be bamboozled by brand. Your advisor needs to know your market intimately demonstrated by having done a significant number of transactions like yours.

Will I be needed after the sale is completed?

You need to be honest with yourself with regards to your role in the business and what you want to do post sale. If you want to leave as quickly as possible that may be understandable but that may well translate as a risk to the buyer and consequently a reduction in price. If the performance of the business depends on your involvement you need to be realistic, what is needed to effect a smooth handover. Further, if you want a future role post the sale then address it early on in the negotiations and establish as

much detail as is reasonable as to what that role might look like. Also be, sure there is likely to be an alignment of interests post any earnout or transition period. If you are rolling over share or other value, be clear on how you will realize that in the future.