Acquire

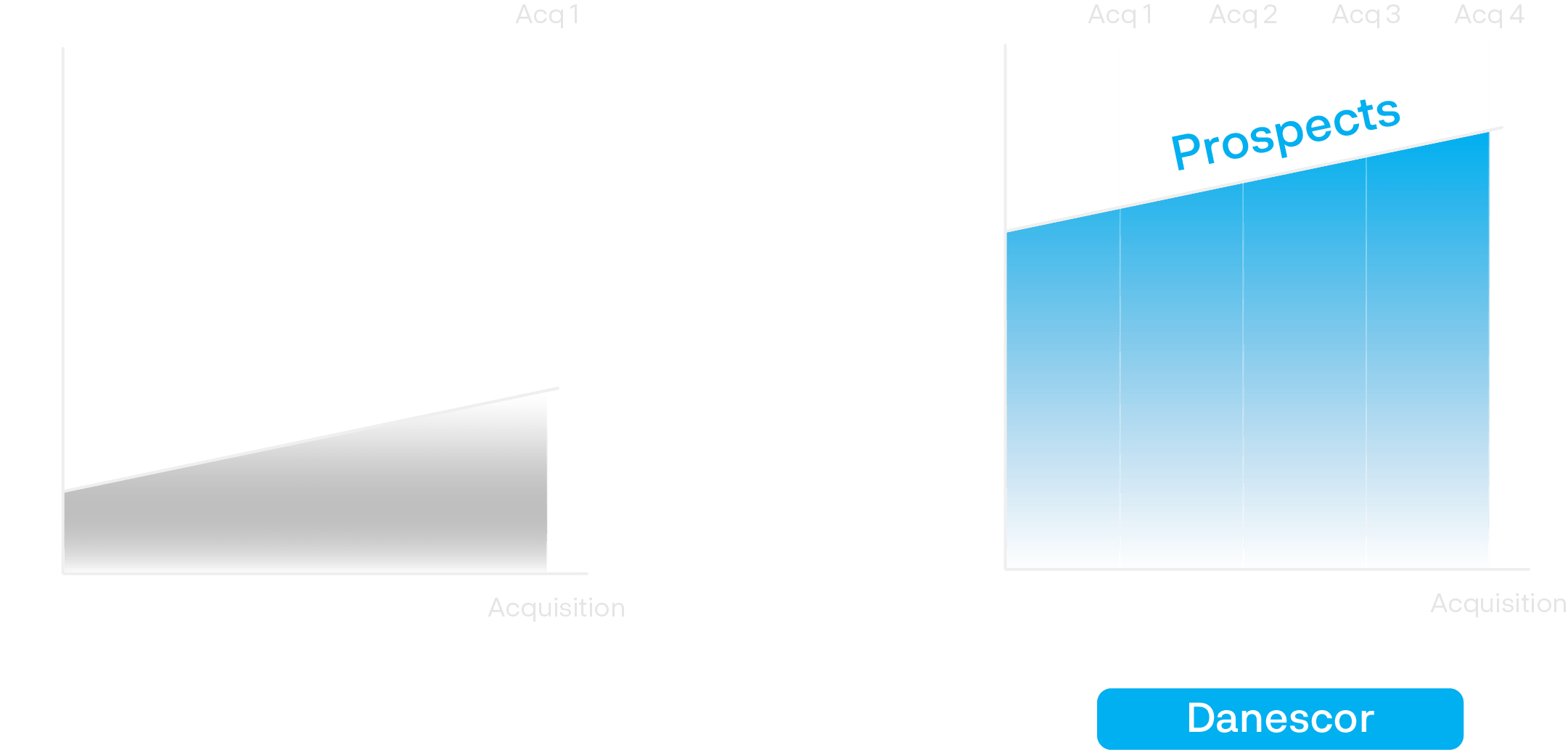

It's a numbers game

Completing an acquisition is one of the most important projects a company will embark on

Not all transactions are equal

Danescor’s leading edge software enables management of large funnels identifying best fit convertible targets

Project Apollo – IT Services

Project Nimbus - Telco

Project Amethyst – SW Dev

Project Hazel - Telco

Project Ohio – MSP

Project Rabat – SI

Project Amber – Data Analytics

Project Kangaroo - DevOps

Project Darwin – Security

Project Apple - MSP

Project Randwick – Telco

Project Malvern – Telco

Project Nimeria – Cyber

Project Cheswick - Telco

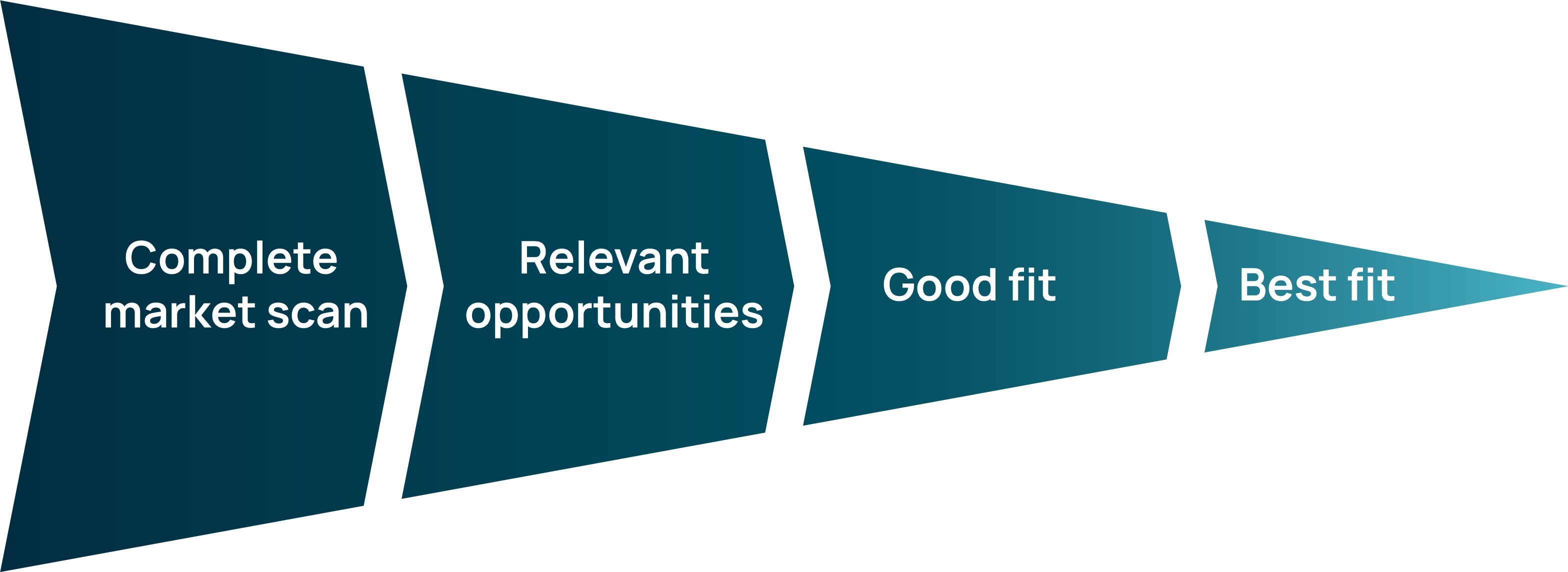

Danescor’s acquisition strategy

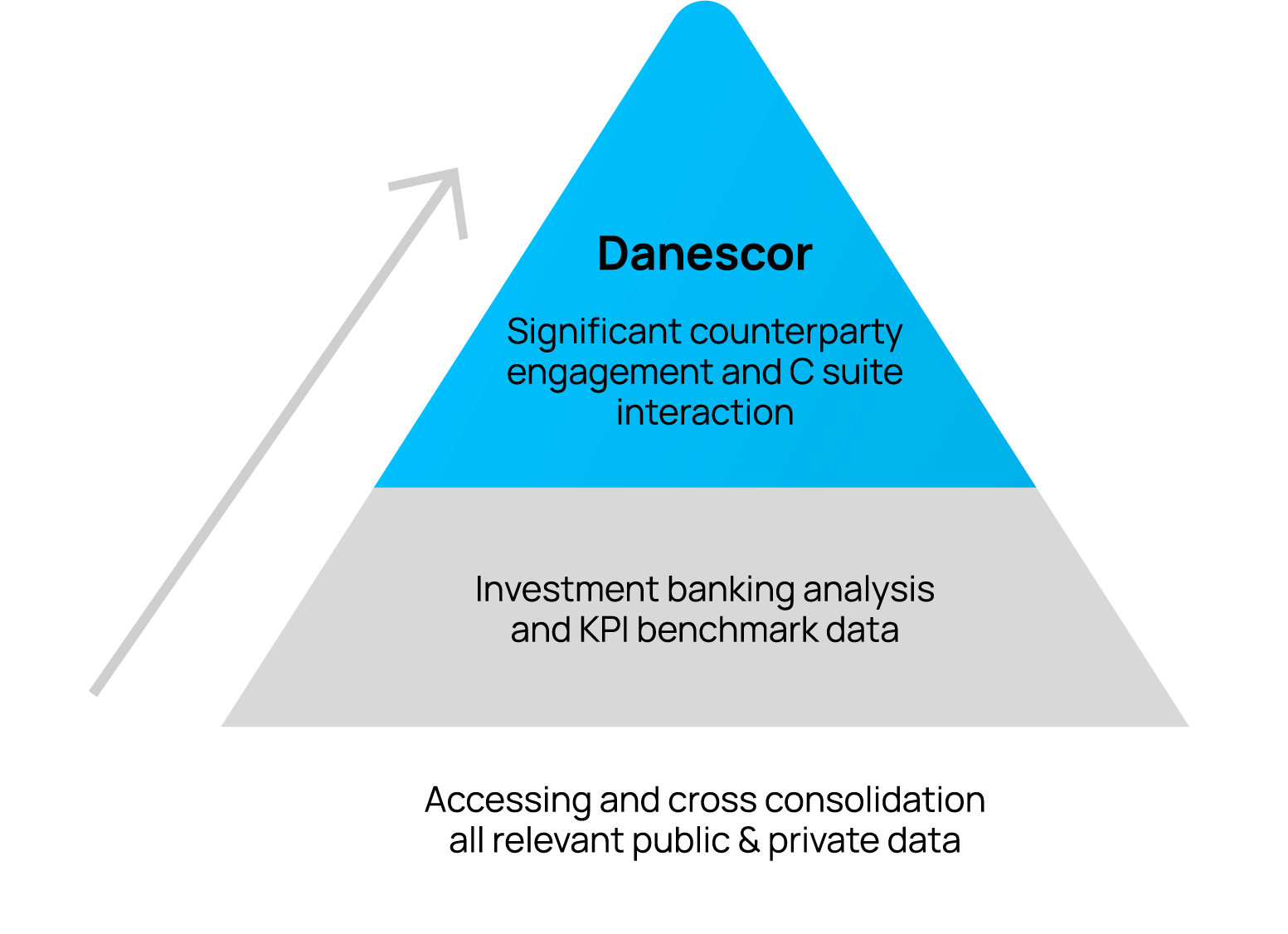

Leverages software, proprietary data, and services to identify & access superior market data

Applies advanced data extraction & query technologies to develop the ideal initial M&A pipeline

Utilizes bleeding-edge transaction management software & resources to prioritize and advance top-tier targets efficiently

Enable clients to maximize resources to realize their top-quartile M&A transactions

Danescor maximizes access to acquisition opportunities

Strategic networks

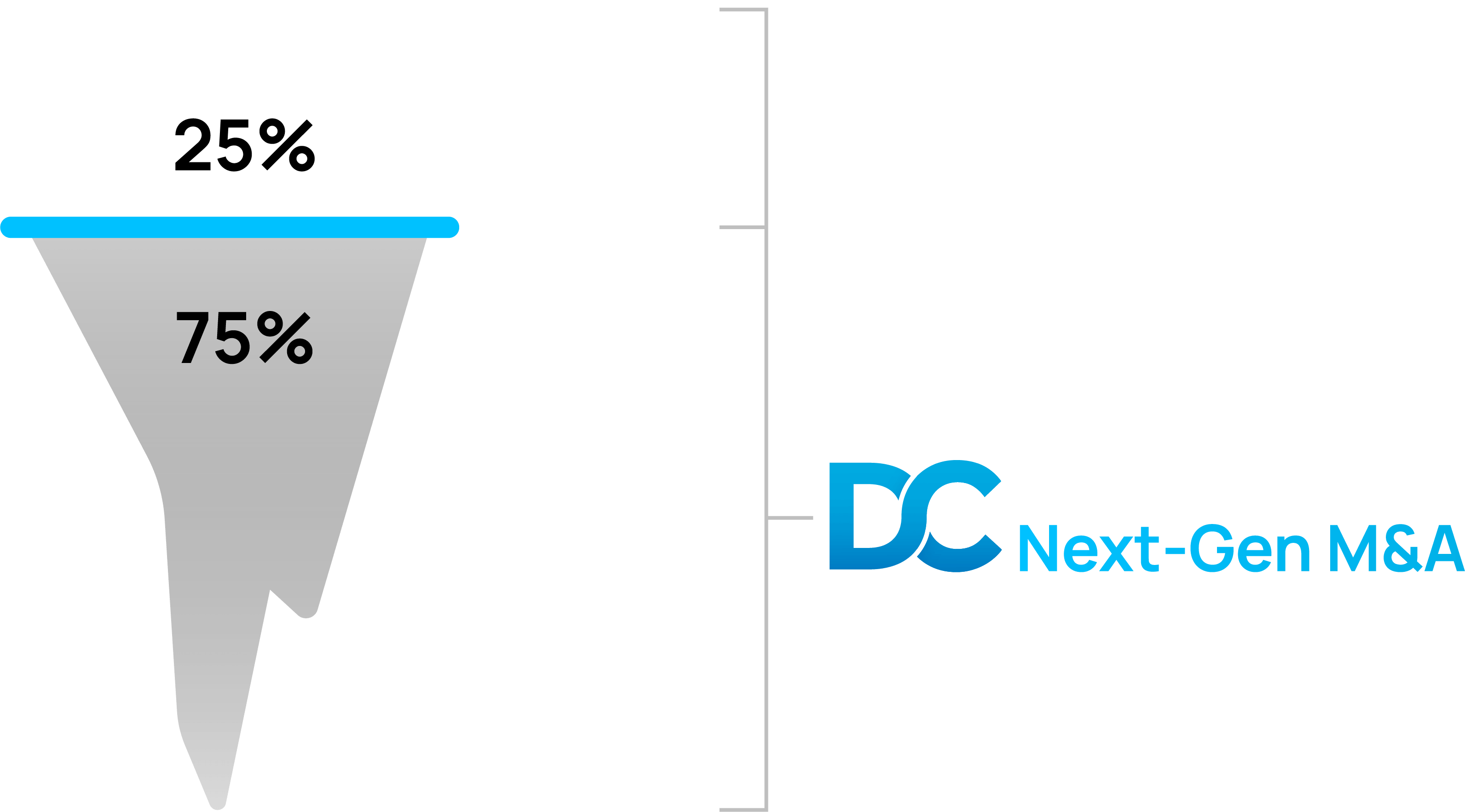

Market leading intelligence for fast, efficient target identification

Access proprietary real-time market information leveraging key data points across thousands of companies and transactions. Seamless project data integration incorporating dynamic market updates together with extensive access to Danescor’s Knowledge & Resource Centre.

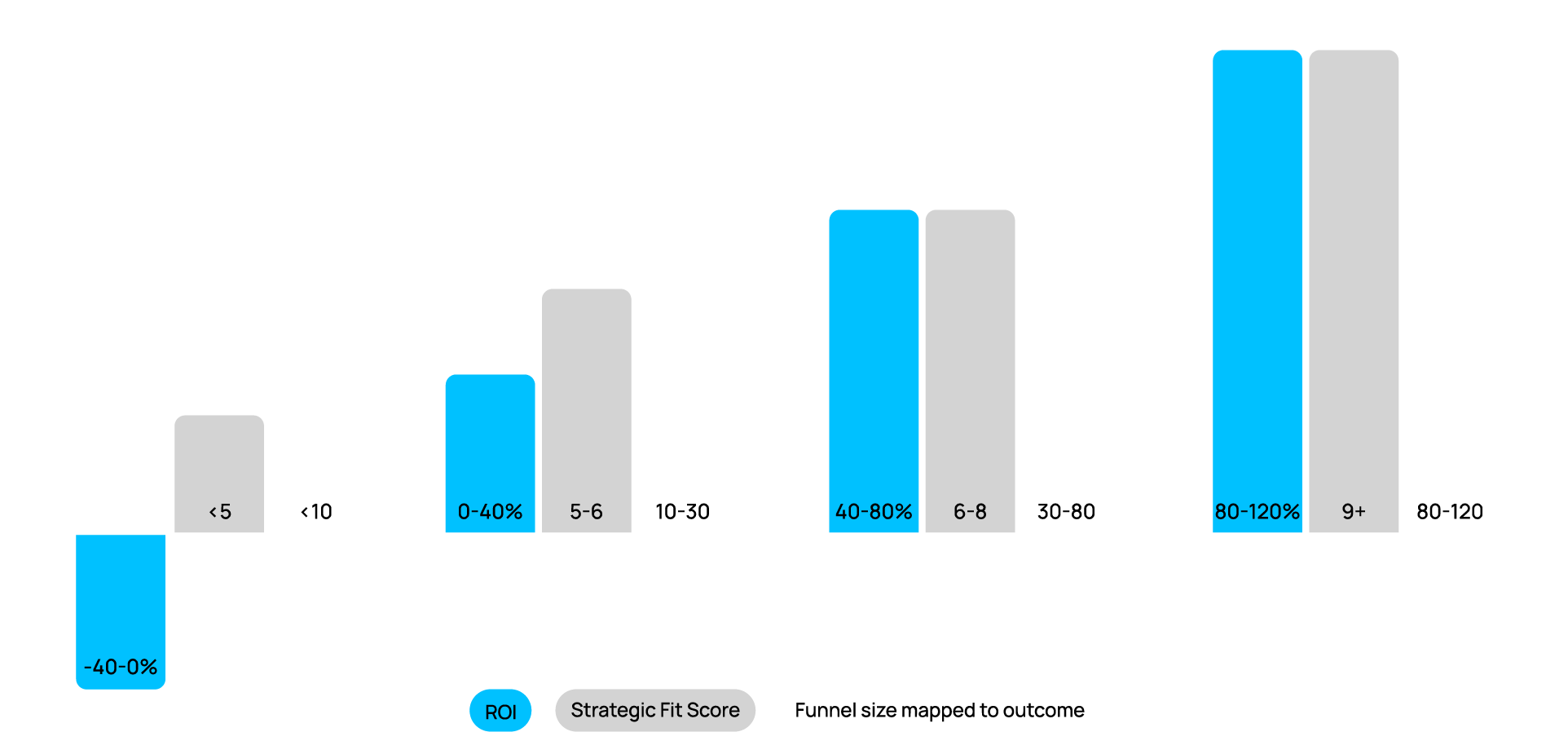

Danescor adopts a structured methodology to ensure clients acquire targets which are a 9+/10 for them thus delivering top quartile ROIs